The changes announced at the Autumn 2024 Budget with regards to Inheritance Tax (IHT) will, in some instances, result in some significant increases to the IHT liabilities estates will face. The following example looks at a typical couple with a mixture of assets, including shares in a family company and pension funds built up over time through their company pension scheme.

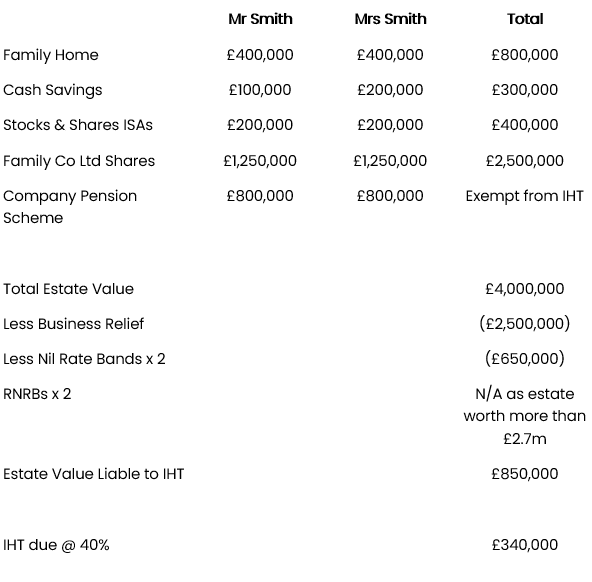

For illustration purposes, the first calculation assumes the couple have mirror wills that leave all their assets to each other on the first death, so the example calculates the IHT liability for the couple jointly following the second death.

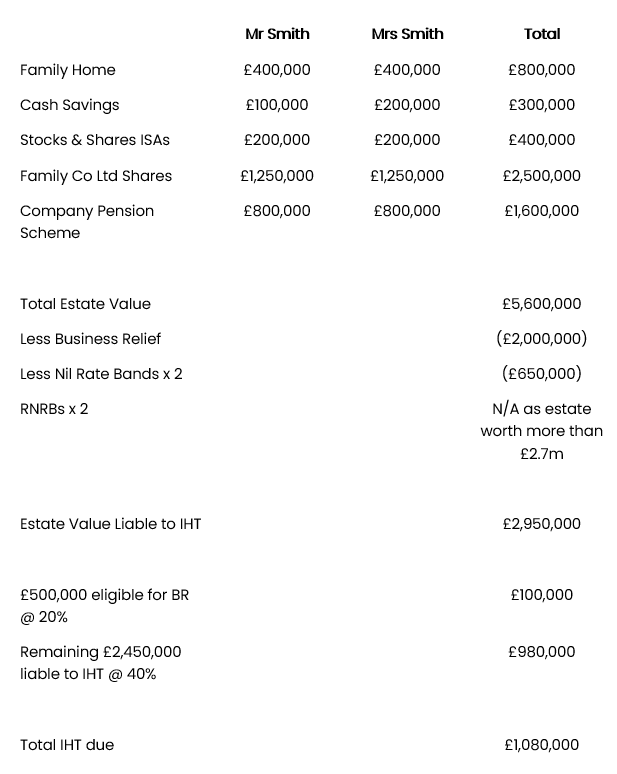

The second calculation is carried out on the basis that the couple change their wills so that assets eligible for business relief up to a value of £1m are left to their

Pre 6 April 2026

Post 6 April 2027

For this couple, the impact of the changes has resulted in their IHT liability increasing from £340,000 to £1,080,000.

So, what can people do to plan for these changes and mitigate the future increases to their IHT liabilities? Over the next few articles, we will look at each of these changes in more detail and outline the planning opportunities available to people looking to reduce their future exposure to IHT.