Aggregates Levy

If you’re dealing with the commercial use of aggregates like rock, gravel, or sand (and anything else mixed in or naturally found with them), there’s a levy you need to know about. This applies to all non-recycled aggregates extracted in the UK or its territorial waters, unless they’re exempt.

Not everything is subject to this levy such as:

- quarried or mined products like clay, slate, metals and their ores, gemstones, semi-precious stones, and industrial minerals.

- There’s also a special exemption for shale that’s not used in construction. If you’ve commercially exploited shale and paid the levy on it, you can claim a tax credit when it’s used in this new exempt process.

The aggregate levy from 1 April 2025 is £2.08 per tonne (£2.03 per tonne 1 April 2024 – 31 March 2025)

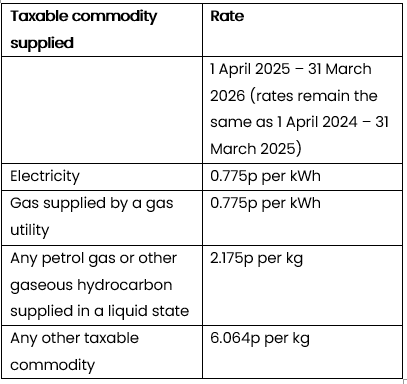

Climate change levy

If you’re supplying energy for industrial or commercial use, there’s a levy you need to be aware of. This applies to energy in various forms: electricity, gas, petrol, liquid hydrocarbon gas, coal, lignite, coke, semi-coke of coal or lignite, and petrol coke.

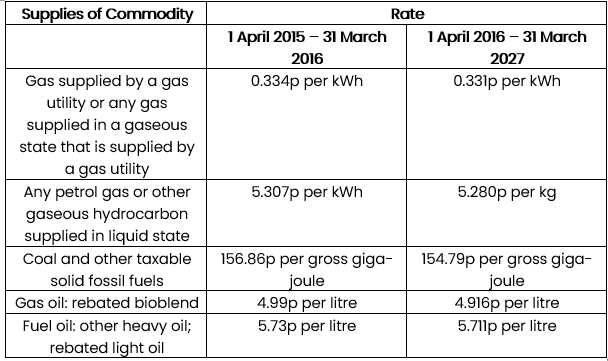

Carbon price support rates for climate change levy and fuel duty

When it comes to generating electricity, supplies of solid fossil fuels, gas, and liquefied petrol gas are subject to the Carbon Price Support (CPS) rates of the Climate Change Levy (CCL). These rates are different from the main CCL rates that apply to consumers’ use of these commodities (and electricity).

Oils and bioblends aren’t taxable under the CCL; instead, they’re taxed under the fuel duty regime. However, there are CPS rates of fuel duty for oils and bioblends used in electricity generation.

If fossil fuels are supplied to an electricity generator using carbon capture and storage (CCS) technology, the CPS rate is reduced by the carbon capture percentage. Small-scale Combined Heat and Power (CHP) stations aren’t subject to the CPS rate, and fossil fuels used in a CHP station to generate good quality electricity consumed on-site are also excluded.

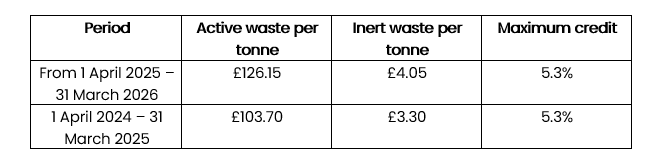

Landfill Tax

When it comes to disposing of material at landfill sites, operators are taxed based on the weight and type of material they deposit. However, there are some exemptions! If you’re dealing with mining and quarrying material, dredging material, pet cemeteries, NATO material, or using inert material to fill working and old quarries, then you escape the tax (caveated!).

However, if you’re operating without the proper license or permit, the tax still applies, and those exemptions won’t save you.

Maximum Credit: If you make donations to environmental trusts, you can get tax credits for 90% of your donation, up to the maximum percentage above of the tax you owe over a 12-month period. It’s a great way to support a good cause and get a little tax relief at the same time.

It is important to note that these tax credits don’t apply if you’re disposing of material at sites without the proper license or permit. So, make sure all your paperwork is in order to take advantage of this benefit!